阅读:0

听报道

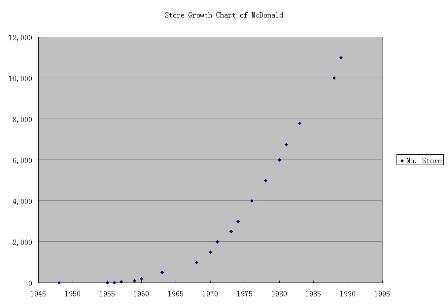

When Ray Kroc took over McDonald and put it on a trajectory growth, it took McDonald 13 years to reach 1000 stores by 1968, and another 3 years to reach 2000 stores by 1971. Coincidentally, after 40 years, McDonald intends to repeat the same history in China.“It took us (McDonald) almost 19 years to reach 1,000 restaurants (in China). We will get our next 1,000 restaurants within three years,” said Kenneth Chan, McDonald’s China CEO in 2010. After McDonald magic has repeated so many times in so many countries, this modest growth plan is also significant in so many ways that can be a testimony and a prophecy not only to McDonald but also to other China’s QSR chains. On the parallel, KFC’s plan to double its store from 3000 to 6000 in the similar time span will intensify the drama of how QSR chains unfold their strategy when China is steering into a market slowdown.

McDonald is the second largest QSR Chain in China behind KFC. Unlike America in its early days, these two brands have dominated the market without any serious competitors from the very beginning. Thus, their status in revenue, store number, development plan and business format is a genereal indicator of the current QSR market in China.

The population in the US was 200 millions in 1968, and China is 1.3 billions in 2012. For the sake of argument, if go by the similar store growth rate, China should have already opened 9500 McDonald stores by now. However, when look at the Real GDP per capita, America was 20,590 USD in 1968 when China is 3,130 USD in 2011. China’s consumption power is not even close to America in 1968 and also far behind America 1955 (15,128 USD of Real GDP per capita). Even more interesting, one McDonald hamburger in 1955 sold for 0.15 USD (~1.29 USD today) in America and had been kept the same for almost ten years, which is about 0.0085% against per capita real GDP. On the other hand, one McDonald hamburger in China in 2012 sold for about 1 USD, which is about 0.0319% against its own denominator.

In its first half century, McDonald was economy proof in America. From the chart above, we can see the growth rate of store numbers shoot up like a straight line for several decades after it reached 2000 stores. Furthermore, when its store number leaped ahead, McDonald’s same store revenue also increased in parallel. This double growth trend sailed through both good time and market downturn. Thus, the significance of how easy the first 2000 stores mark can be passed is a prophecy to McDonald's potential growth in the following years. KFC has already open nearly 4000 stores by now in China. However, we can see its growing pain. It drastically revamps its menu in the past four years. KFC's success in spite of its ambiguous positioning and further departure from the core of QSR business concept shows the strength of a brand, but also manifests the lack of competition and creativity especially by domestic players. As an old guard of QSR, McDonald has kept its menu similar to its global one when KFC has made constant changes in its and added a long assortment. Will McDonald make similar transaction as KFC did? Will KFC be able to fight off the competition once if the domestic players are able to develop into a more specialized, sophisticated and creative operators?

In China, McDonald’s real challenge is just started. After 4000 billions RMB governments stimulate investment since 2008, China was like high on drug in all sectors and all factors, high flying from inflation, real estate, to labor cost. Both McDonald and KFC are also spirited by this nation, which hasn’t suffered a real economic downturn since the early 1990s. Time changes. China right now is about to go through a rough economic time. In consumer market, the certain economic centers have already felt the woe of a cooling economy. Some domestic QSR chains, who follow McDonald and KFC every step, are hit hard first. Although the immediate threat to the current establishment of McDonald and KFC is still not clear, the impact on their growth plan will test how well their business model can deal with such a slow-down in the market, and a necessary reflection of the current QSR business model in China.

In its first half century, McDonald was economy proof in America. From the chart above, we can see the growth rate of store numbers shoot up like a straight line for several decades after it reached 2000 stores. Furthermore, when its store number leaped ahead, McDonald’s same store revenue also increased in parallel. This double growth trend sailed through both good time and market downturn. Thus, the significance of how easy the first 2000 stores mark can be passed is a prophecy to McDonald's potential growth in the following years. KFC has already open nearly 4000 stores by now in China. However, we can see its growing pain. It drastically revamps its menu in the past four years. KFC's success in spite of its ambiguous positioning and further departure from the core of QSR business concept shows the strength of a brand, but also manifests the lack of competition and creativity especially by domestic players. As an old guard of QSR, McDonald has kept its menu similar to its global one when KFC has made constant changes in its and added a long assortment. Will McDonald make similar transaction as KFC did? Will KFC be able to fight off the competition once if the domestic players are able to develop into a more specialized, sophisticated and creative operators?

In China, McDonald’s real challenge is just started. After 4000 billions RMB governments stimulate investment since 2008, China was like high on drug in all sectors and all factors, high flying from inflation, real estate, to labor cost. Both McDonald and KFC are also spirited by this nation, which hasn’t suffered a real economic downturn since the early 1990s. Time changes. China right now is about to go through a rough economic time. In consumer market, the certain economic centers have already felt the woe of a cooling economy. Some domestic QSR chains, who follow McDonald and KFC every step, are hit hard first. Although the immediate threat to the current establishment of McDonald and KFC is still not clear, the impact on their growth plan will test how well their business model can deal with such a slow-down in the market, and a necessary reflection of the current QSR business model in China.

In fact, QSR has always shown the resilience in a market downturn. Thus, this coming storm (if not revert by another stimulate plan by the government) is going to be a testimony to China’s current QSR model. China’s true potentials as a consumer market have yet to show its power. There are many ways to make a QSR business work even in the worst time. Because of the double digits GDP growth in the past decade, the real incentives to improve the current QSR model were not there. For now, we can just pay a lot of attention to see how McDonald and KFC will steer their business through the coming storm.

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号