Coffee: Devil’s Drink, Devil’s Market

Coffee has been called a ‘devil’s drink’. It has a unique appeal deeply rooted in modern society and shows the sophistication of its clienteles. In addition, coffee is such an informative and societal drink that it can work as an indicator to manifest the level of overall economic, political and cultural development of a country in an integrated global setting. In turn, each individual societal environment conditions the potentials of that particular coffee market, which renders coffee to have a different market path in comparison to the consumer goods such as soda and hamburger.

Because of its halo image, coffee tends to radiate unusual fascination and encourages many ventures. However, coffee can also be cold as devil to business if it doesn’t realize particularities of coffee as a consumer product and doesn’t take its societal influence seriously, especially in emerging markets.

Although the static chart shows the potentials of the coffee market, it can not shed much light on market behaviors of a particular market and how likely it may evolve in the near future.

Country by Country on Marco Factors

1. Mature Coffee Market:

|

Most Established Coffee Market |

|||||

|

|

Per Capita GDP Ranking: (IMF) |

Political Factor: |

Coffee Popularization Movement |

Population |

Gross Coffee Consumption (~2008) |

|

|

Depth of Economy |

Libertarian of a Society |

Social Culture |

|

(Unit: |

|

The |

9 |

Multi Parties System |

Grass-roots |

310,504,000 |

20,700,267 |

|

|

19 |

Multi Parties System |

Grass-roots |

81,757,600 |

8,857,073 |

The

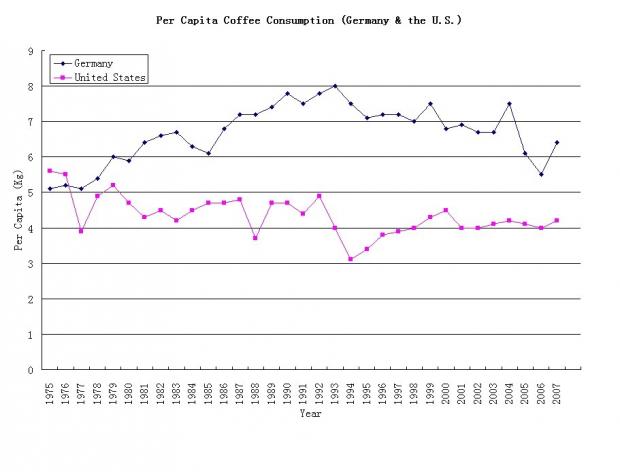

In grass-roots coffee movement, coffee popularization is in parallel with economic and political evolution, which is in contrast to Asian countries’ top-to-down coffee popularization. In grass-roots scenarios, the per capita coffee consumption can peak well before economic and political factors become fully ripe. It is the case of

2. Top-to-down Coffee Evolvement:

|

Newly Established Coffee Market |

|||||

|

|

Per Capita GDP Ranking: (IMF) |

Political Factor: |

Coffee Popularization Movement |

Population |

Gross Coffee Consumption (~2008) |

|

|

Depth of Economy |

Libertarian of a Society |

Social Culture |

|

(Unit: |

|

|

17 |

Multi Parties System |

Top-to-down |

127,360,000 |

7,960,000 |

|

|

33 |

Multi Parties System (for near 30 years) |

Top-to-down |

48,758,000 |

1,462,740 |

Economic stagnation in

Instant coffee and bottled coffee dominate both markets, which is a common phenomenon for most of emerging coffee markets. For that, instant coffee is less likely to develop a morning coffee drinking habit. Both coffee markets have been slowing down significantly in the past five years, which still have large room for coffee consumption growth. New categories and segments of their markets are keys for growth. In both countries, pricing is more important than its western counter-parts.

3. Culture factors:

|

Newly Established Coffee Market |

|||||

|

|

Per Capita GDP Ranking: (IMF) |

Political Factor: |

Coffee Popularization Movement |

Population |

Gross Coffee Consumption (~2008) |

|

|

Depth of Economy |

Libertarian of a Society |

Social Culture |

|

(Unit: |

|

|

17 |

Multi Parties System |

Top-to-down |

127,360,000 |

7,960,000 |

|

Czech |

35 |

Multi Parties System (for near 30 years) |

Grass-roots |

10,674,947 |

711,663 |

|

|

50 |

Multi Parties System (for near 30 years) |

Grass-roots |

38,192,000 |

2,100,560 |

All three countries have similar per capita consumption although it took

4. Political Factors:

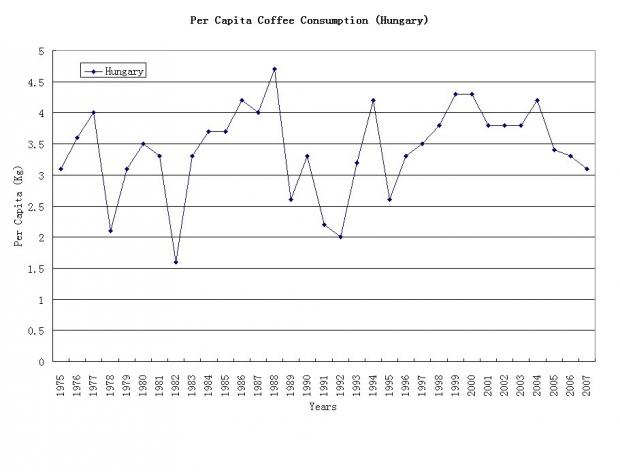

The chart above shows how political factors impact on the coffee market. Before and after the collapse of the Berlin Wall, it shows a sharp contrast in coffee consumption. However, the long term forecast about coffee market is also tied with economy.

|

Newly Established Coffee Market |

|||||

|

|

Per Capita GDP Ranking: (IMF) |

Political Factor: |

Coffee Popularization Movement |

Population |

Gross Coffee Consumption (~2008) |

|

|

Depth of Economy |

Libertarian of a Society |

Social Culture |

|

(Unit: |

|

|

67 |

Multi Parties System (for near 30 years) |

Grass-roots |

21,959,278 |

878,371 |

|

|

76 |

Multi Parties System (for near 30 years) |

Grass-roots |

7,576,751 |

378,838 |

|

|

45 |

Multi Parties System (for near 30 years) |

Grass-roots |

10,005,000 |

583,625 |

Another interesting factor is that it is a bottleneck when per capita consumption reaches 3.5 kilo. It still has a lot to do with political and economic factors. More socialist North-western European countries are all reaching 6 kilos.

5. The Interesting Countries:

|

Future Coffee Market |

|||||

|

|

Per Capita GDP Ranking: (IMF) |

Political Factor: |

Coffee Popularization Movement |

Population |

Gross Coffee Consumption (~2008) |

|

|

Depth of Economy |

Libertarian of a Society |

Social Culture |

|

(Unit: |

|

|

95 |

One Party System |

Top-to-down |

1,338,612,968 |

35,250 |

|

|

137 |

Multi Parties System |

- |

1,191,728,000 |

1,986,213 |

|

|

116 |

One Party System |

- |

79,089,650 |

131,816 |

Number does not lie. Gross coffee consumption for all countries listed in this article shows how influential of all three factors have impact on a country.

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号